Table of Content

You always know exactly what your mortgage rate and monthly payment amount are since they never change. Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after the closing date for adjustable-rate mortgage loans.

They can also show whether houses are moving quickly off the market or taking a while to sell. Colorado homes sold for 20.8% less than the asking price in October 2022, a 28.0 percent decrease from the previous year. Only 43.2% of properties saw price decreases, which is an increase from the 19.0% of homes in October of last year. The sale-to-list price was 98.4%, down 2.6 points from the previous year. Colorado had 27,921 properties for sale in October 2022, an increase of 6.3% from the previous year. 7,493 new residences were listed, which is a 28.9% decrease from the previous year.

What You Should Know About Buying a Home in California

Before committing to an ARM it’s a good idea to calculate whether you could afford to pay the maximum interest rate allowed under the proposed loan terms. We’re guessing you wouldn’t want to be stuck with unaffordable monthly payments after your mortgage rate adjusts. Mortgage refinancing is a good option for lowering mortgage costs. The borrower can get the several benefits of refinancing if he knows the right time of refinancing.

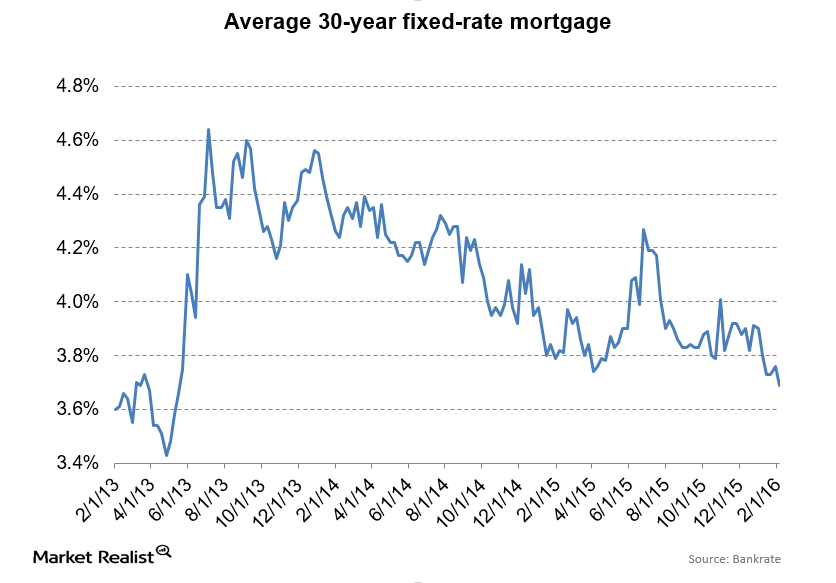

If you have specific questions about the nuances of applying for a mortgage, refinancing or buying a home in California, a mortgage banker or realtor licensed to work in the state can be a great asset. Calexico, CA — Living in Calexico is slightly more expensive than the other cities on this list, but is still well below the cost of living in the rest of the state. Barstow, CA — Barstow, which is halfway between Los Angeles and Vegas, is a small California town with an affordable cost of living. The median value of a home in Barstow is only $107,100 and the median monthly cost of ownership is $1,116. All fixed-rate loan products followed the same trend upward and then downward trend as the 30-year fixed-rate loans.

Home Equity Loans And Helocs In California

Two of those factors are the median home price and median monthly ownership costs for homes in California, which are significantly higher than the national average across the board. The state also has the 11th highest average cost of homeowner’s insurance, and when it comes to the cost of living, the state ranks as the 2nd most expensive, only after Hawaii. Getting a mortgage in California can be different from shopping for a mortgage in other states.

Whether you’re ready to buy or refinance, you’ve come to the right place. Compare California mortgage rates for the loan options below. Information provided on Forbes Advisor is for educational purposes only.

Year Fixed Mortgage Rates in California

Calculate your mortgage loan payment for a home in California. Start by finding your current mortgage rate using the filters above. Then enter your rate, home price, down payment, and loan term into the mortgage calculator below to estimate your monthly payment. The Home Affordable Refinance Program no longer exists, but the primary alternative is the High Loan-to-Value Refinance Option from Fannie Mae. If you don’t qualify for this program, you can shop around for a refinance mortgage from the lender who issued your original mortgage and compare refinance mortgage rates from other lenders as well. Note that refinance loans in California are also non-recourse loans, unless you opt for a cash-out refinance to get cash out of your home equity for something like a vacation or to pay off debt.

Your individual rate will vary depending on your location, lender and financial details. As a homebuyer, you are in the drivers seat to a certain degree. How youve handled money in the past is a big factor in how much house you can afford and what your monthly payment will be.

When Is The Best Time To Refinance To Get A Lower Rate

Estimated monthly payment and APR calculation are based on a down payment of 3.5% and borrower-paid finance charges of 0.862% of the base loan amount. Estimated monthly payment and APR assumes that the upfront mortgage insurance premium of $4,644 is financed into the loan amount. The estimated monthly payment shown here does not include the FHA-required monthly mortgage insurance premium, taxes and insurance premiums, and the actual payment obligation will be greater. Jumbo Loans - Annual Percentage Rate calculation assumes a $940,000 loan with a 20% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees if applicable. Jumbo rates are for loan amounts exceeding $647,200 ($970,800 in Alaska and Hawaii).

Rates were constant through mid-2018 and then spiked upward at the end of 2018 and the start of 2019. Following the spike, the rates began a slow descent, eventually landing at the lower rates, where they currently sit. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. A number of California counties have conforming loan limits that are higher than the standard $647,200. That long list of counties with higher conforming loan limits gives you an idea of how expensive homes in California are.

The average 30-year jumbo mortgage rate in California is 3.31% (Zillow, Jan. 2022). In some states, the lender has recourse to go after you for that deficiency. For example, the lender could go after other assets of yours like your savings account or your wages. But because California is a non-recourse state, you generally won’t be liable for the deficiency if you experience foreclosure in the Golden State .

Its important to keep these four facts in mind when you compare online mortgage rates.The rates listed are not quotes. A high credit score shows you pay your bills on time and/or use your credit responsibly. You are a lower risk of default when you have a high credit score and lenders reward you with lower interest rates.

No comments:

Post a Comment