Table of Content

This results in predictable monthly payments and stability over the life of your loan. A 30-year, fixed-rate mortgage is the most popular home purchase financial product because it’s often more affordable than other shorter-term mortgage loans. That gives homeowners a little more wiggle room in their budget, while keeping the certainty that the monthly payment will never change. Once you decide which mortgage type fits your needs, you can begin comparing current mortgage options. Bankrate offers a mortgage rates comparison tool to help you find the right rate from a variety of lenders. You can use a mortgage calculator to determine how different mortgage rates and down payments will affect your monthly payment.

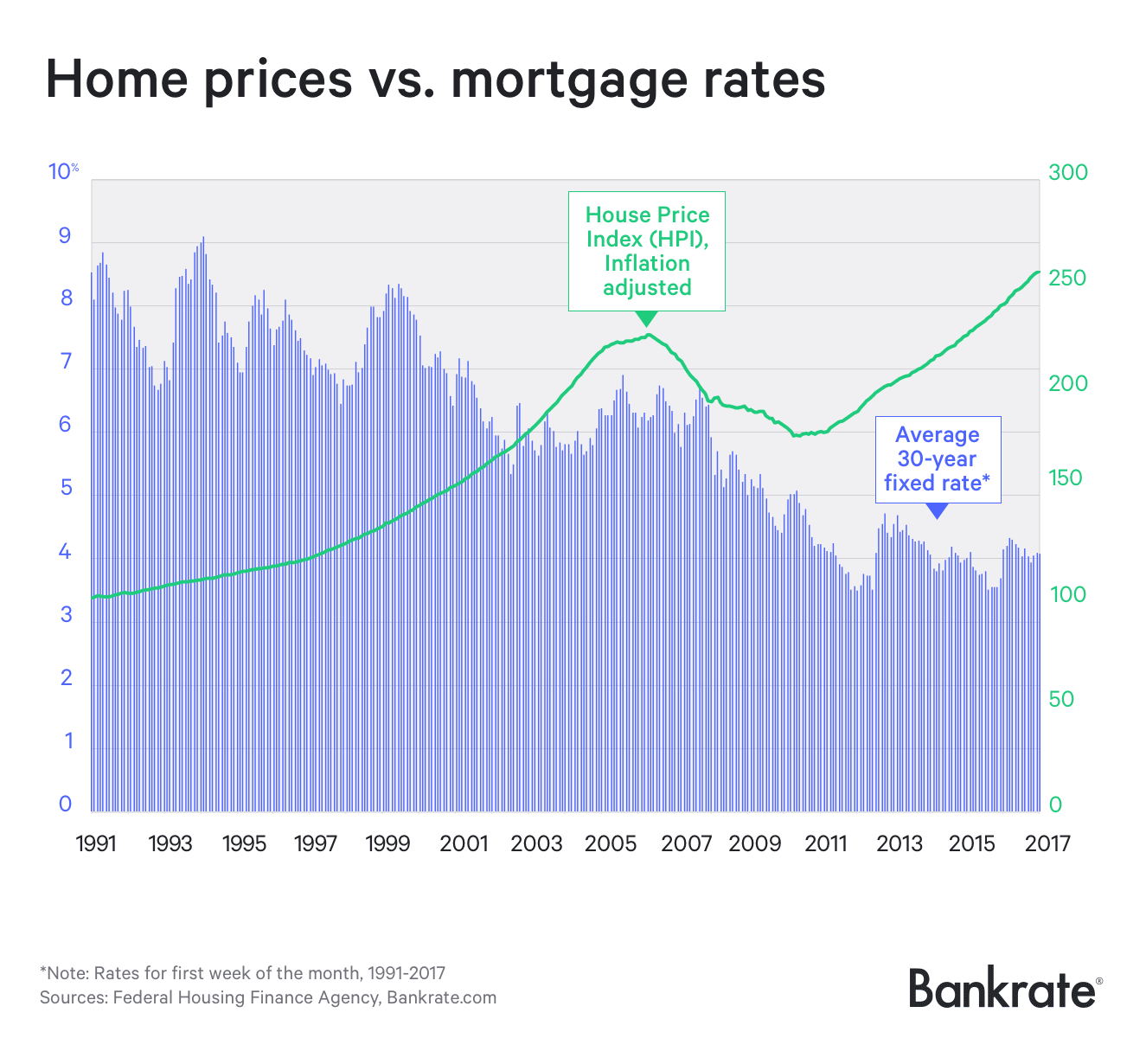

In the current environment, ARMs might be more affordable than those with fixed rates. Median age and Income of Repeat Buyers – The average age and income of repeat buyers remains relatively stable, with a median age of 53 and an income of approximately $95,000 per year. The average cost of a home purchased by a repeat buyer is $240,000. Interest rates on a 30 year fixed-rate mortgage were at their highest when they peaked at 18.45 during the fourth quarter of 1981.

SPECIAL HOME LOAN RATES

Lenders have settled on this three-digit score as the most reliable predictor of whether you’ll make prompt payments. The higher your score, the less risk you pose in the lender’s view — and the lower rate you’ll pay. There has always been a small percentage of mortgages that slip into delinquency or default, regardless of the prevailing economic climate.

Homebuyers are also set to get a reprieve from record-high home prices. Redfin's2023 housing forecastsees home sales sinking to their lowest level in more than a decade. Typically, it only takes a few hours to get quotes from multiple lenders — and it could save you thousands in the long run. The lender or loan program that’s right for one person might not be right for another. In fact, first-time home buyers put only6 percent downon average. Nowadays, mortgage programs don’t require the conventional 20 percent down.

Learn about Mortgage Refinancing

Try to get a quote with a soft credit check which won't hurt your credit score. Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, you’re basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term. Some buyers finance their new home's closing costs into the loan, which adds to the debt and increases monthly payments. Closing costs generally run between 2% and 5% and the sale prices.

So get multiple quotesfrom at least three different lenders to find the right one for you. Some simplygo with the bank they use for checking and savings since that can seem easiest. Remember, every mortgage lender weighs these factors a little differently. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs.

What are points on a mortgage rate?

Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria. Our advertisers do not compensate us for favorable reviews or recommendations. Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information. You’ll also want to consider how long you plan on staying in your home as the closing costs can eat up your savings if you sell shortly after refinancing.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates. This means if the interest rate increases before your loan closes, you get the stated rate. However, if rates fall, you won’t benefit unless you restart the loan process, a costly and time-consuming endeavor.

Compare the national average versus top offers on Bankrate to see how much you can save when shopping on Bankrate. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. Be sure to ask your lender about the consequences of not closing within the timeframe specified in a rate lock agreement and also about what could happen if rates fall after you lock in a rate. Consider options from as many mortgage lenders as possible to find the best deal for you. Prospective buyers have saved more than $1,500 over a loan’s term by getting two quotes from lenders, and saved roughly $3,000 when they sought five quotes, according to Freddie Mac.

For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. There are a complex set of factors that impact mortgage interest rates, including broader economic conditions, the monetary actions of the Federal Reserve and inflation. However, long-term mortgage rates are directly impacted by the bond market. The rate you’re offered on a mortgage will also depend on the lender you work with, its business costs and your financial profile. A credit score of 720 or above is considered good, while a score of 760 or above is considered excellent.

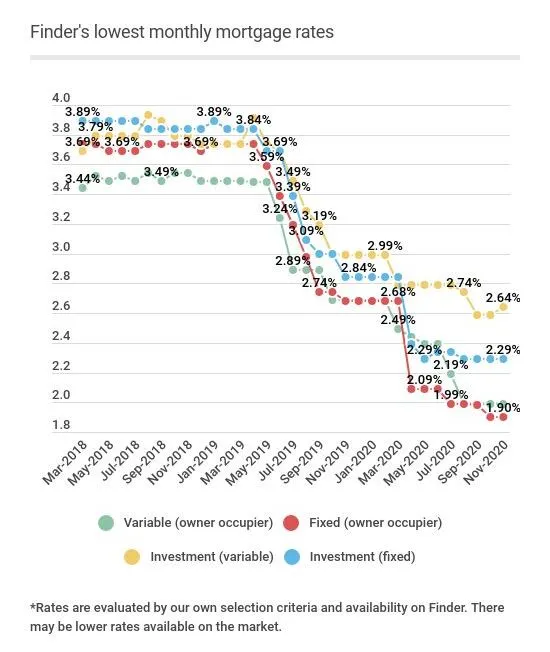

This may influence which products we write about and where and how the product appears on a page. It takes less than a minute to get options from highly rated lenders. Large economies like the US have big effects on smaller markets like Australia. If the US Federal Reserve (America's version of the RBA) moves interest rates up or down, Australia is likely to follow to some degree. It's a helpful way to see just how much you can save by comparing interest rates.

The average rate on a 5/1 adjustable rate mortgage is 5.46 percent, falling 2 basis points over the last 7 days. If you lock in today’s 5/1 ARM interest rate of 5.46% on a $100,000 loan, your monthly payments will be $565. A 15-year fixed-rate mortgage of $100,000 with today’s interest rate of 6.07% will cost $848 per month in principal and interest. Over the life of the loan, you would pay $52,576 in total interest. Lenders usually don’t want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. For example, if your total monthly income is $7,000, then your housing payment shouldn’t be more than $2,170 to $2,520.

If you have the means to make higher monthly mortgage payments, a 15-year mortgage might be a better option for you. In contrast, a 30-year mortgage might be better for someone who has a more limited budget or who wants to be able to save cash while making mortgage payments at the same time. At today's average rate, you'll pay $639.32 per month in principal and interest for every $100,000 you borrow. The average rate for a 30-year jumbo mortgage is 6.61 percent, a decrease of 2 basis points over the last week. A month ago, jumbo mortgages' average rate was higher, at 6.84 percent.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn't get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first. The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes. You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay.

1 adjustable rate mortgage drops, -0.02%

While it’s not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan. If you’re hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile. Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years. Your credit score is the most important driver of your mortgage rate.

It also gives the borrower a longer window to decide whether they want to sell down the road and pay off the mortgage. They also have the option to refinance into a shorter term loan or one with a lower interest rate if rates drop. By taking a longer period of time to repay your mortgage, you’ll pay more in interest costs. There are other mortgage products that have shorter terms, like 15 and 20 years. You can compare costs using a 15-year vs. 30-year mortgage calculator as an example. Mortgage rates have been increasing consistently since the start of 2022, following in the wake of a series of interest rate hikes by the Federal Reserve.

No comments:

Post a Comment