Table of Content

Preferably, a credit score of 750 and above is deemed ideal to secure competitive interest rates from lenders. Similarly, the interest rate for a 55-year old salaried applicant would be more as he/ she would retire from the job soon. Shubham Finance has five years of experience in providing excellent financial aid for Mumbai-based individuals.

Keep all property related documents – It is very important to maintain and keep all the property documents with you. As it helps the lender identify your property and its worth properly and thus trust your profile. High Income – A person earning high income has more chances of getting lower rate and higher amount. Malad – Malad offers a host of great residential properties. It is a very popular area owing to the infrastructure, connectivity, and other amenities.

Finance for Professionals

The interest rates for HDFC home loan Mumbai starts from 6.75% p.a. Popular home loan schemes of HDFC includes, home loan balance transfers, HDFC Reach Home Loan. The eligibility criteria are related to your age, income, past repayment history and the cost & location of the property. They normally lend up-to 65%-70% of the monthly income as a home loan subject to your obligation. The eligibility criteria vary across the lenders, home loan schemes, FOIR & LTV % & CIBIL score requirement.

It ends your worries of “Which bank gives lowest interest rates for home loan in Mumbai” by providing you with best and the lowest Housing loan interest rates in Mumbai. Apply with us today for your joint home loan, home mortgage loans, home improvement loans, home renovation loans & bank loan for house with lowest home loan interest rates in Mumbai. While switching from a fixed rate to a floating rate means considerable benefits for borrowers in terms of interest savings.

Home Loan Details

So, you cannot use the pre-EMI as the tax deduction source. For Interest paid - Under Section 24 of the Income Tax Act for the maximum tax deduction of up-to Rs.2 Lakhs p.a. For self-occupied properties while there is no limit for let out properties. Avail pre-sanction home loan even before finalizing the property. Park the excess funds and save on the interest cost with smart home loans in Mumbai.

Apply for maximum tenure - maximum loan tenure will reduce your monthly outgo. Proof of Identity, address, income, age, property, etc are required to apply for a home loan. Apply at young age – If you age at the time of applying is in early 30s or late 20s. You are more eligible for a higher loan amount as you have less financial liabilities. Make sure you have income proof – Many people do not know that your loan application may be rejected. Only a few NBFCs accept such cases but then they give high rates.

How Can You Make the Most of Lower Home Loan Interest Rates?

We believe that your home loan interest rates should be as low and affordable as possible. Hence why we offer competitive housing loan interest rates for all applicants – whether salaried or self-employed. Bajaj Housing Finance extends competitive Home Loan interest rates to borrowers to make financing convenient and repayment affordable in the long term.

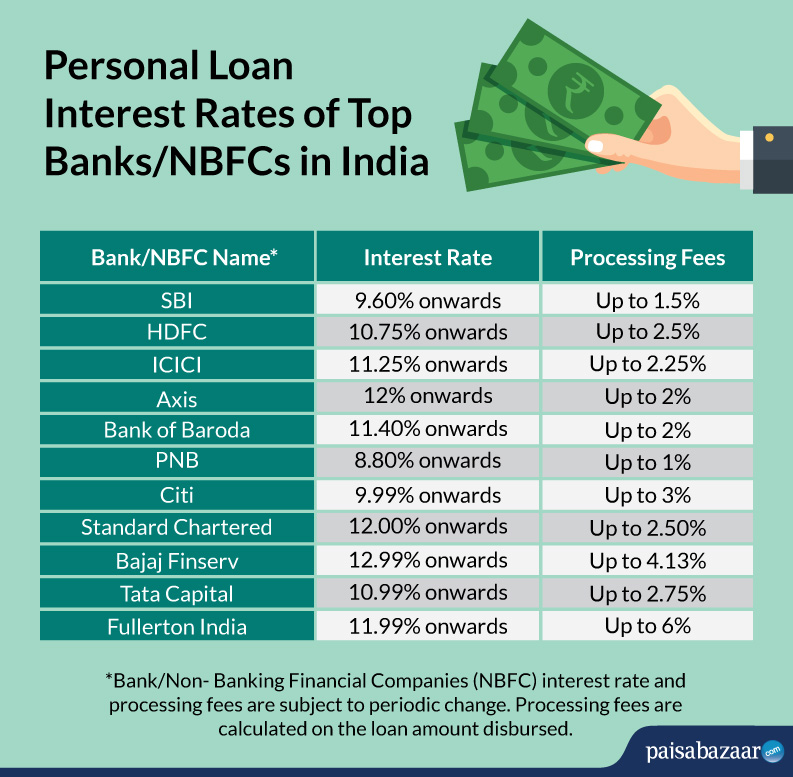

However, you must be minimum 21 years and have a regular flow of legal income to apply for a home loan in Mumbai. Yes, if another bank is offering you a lower rate of interest on your existing home loan, then you can opt for a home loan balance transfer. However, it is important to check with your bank whether it offers a home loan balance transfer facility or not. Below is the table showing the interest rates and processing fee of home loans offered by several lenders. I availed home loan from Federal bank, I took Rs.30 lakhs principal for the duration of 15 years. The rate of interest was floating around 8.75% per annum, they taken some processing fee around Rs.20,000 but there is no stamp duty and insurance charges.

How to reduce your interest outflow while repaying a Home Loan

It is well connected with South Mumbai through the Western Railway. At the moment bajajfinservmarkets.in site and our products are available only in India. For a complete list of interest rates, please click here. Choice has rich experience in Retail Loans.We have good team of professional personnel and backed by well efficient service assurance.

All the parts of Mumbai and its suburbs are well connected via rail, roads and metro trains/mono rails. This connectivity helps the commuter to easily travel in Mumbai. The following are the best locations to buy a property in Mumbai. Click get started to get the free quotes of the top banks. If you have paid any principal amount, that is not eligible for the tax deduction.

Fixed rates remain constant throughout the loan tenor, and floating rates are affected by policy rate changes introduced by the RBI. Remember, fixed rates are usually 1–2.5% higher than floating interest rates. However, you can also switch from fixed to floating interest rate and vice versa during the loan tenor based on your requirements. Loan-to-value ratio is the percentage of the property’s market value the lender offers as a loan.

This is a good option if you don’t want to take a risk and want to pay a pre-determine rate of interest. Keep EMI unchanged - reduce the home loan tenure and settle the loan in less time by paying less interest amount to the lender. Home loan top up loans in Mumbai available at the lowest home loan rates Mumbai. You can compare all the home loan banks on the basis of loan amount for upto 30 lakh, above 30 lakh to 75 lakh and above 75 lakhs. Most of the banks offer different rates as per the loan amount.

You can apply for a home loan to serve various purposes like buying a new or resale flat, purchasing a land to construct a house on the same, extend or renovate an existing home. For salaried, the minimum age by which they can apply for a home loan is 21 years. The maximum permitted for them at maturity is not more than 58 years. Self-employed can apply after attaining the age of 24 years and must ensure his/her age does not go past 65 years at the time of loan maturity. I got my home loan from HDFC LIMITED because the builder has processed the loan. The rate of interest is nominal and they have scheduled for floater plan.

To lend a helping hand to our customers, LoanCounsellor has consolidated all the necessary information regarding current Rate of interest on home loans provided by all the major banks in India. Please keep visiting this section to check latest rate of interest for home loans. You can also choose to foreclose the loan altogether to cut down on any new interest accumulation on the outstanding principal. Bajaj Finserv extends part and full prepayment facilities on floating rate home loans at nil charges to increase your affordability. You can avail of a home loan at any of the three types of interest rates, fixed, floating or mixed.

Documentation For Home Loan In Mumbai

There are many factors that affect Housing Loan interest rate, including external market conditions, such as the repo rate and inflation. Some of the other factors that affect Home Loan interest are in your control. These depend on your eligibility for the loan and aspects such as your income, credit score, and more.

A borrower’s housing loan interest rate is thus set to be higher for a longer tenor and lower for a shorter period of repayment. LTV is the maximum loan amount a lender extends to home loan applicants as a percentage of the property’s current market value. A high LTV, while bringing suitable financing value, also translates to a higher loan amount and increased risk of lending. Borrowers can increase their down payment amount to reduce the total loan amount for an affordable housing loan interest rate.

No comments:

Post a Comment