Table of Content

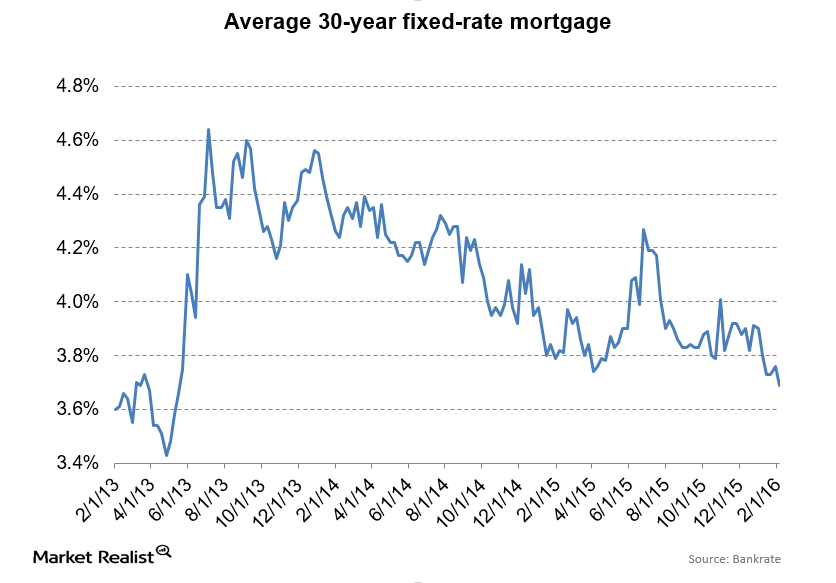

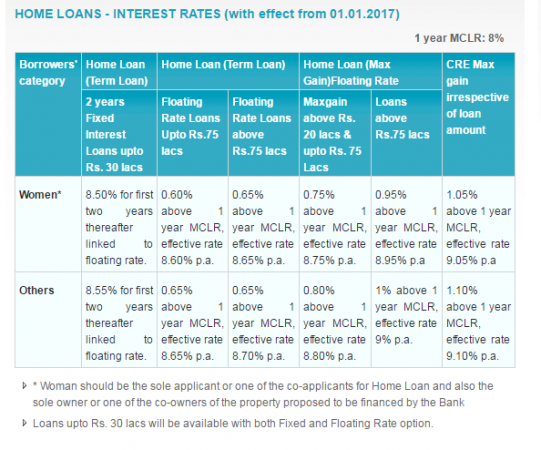

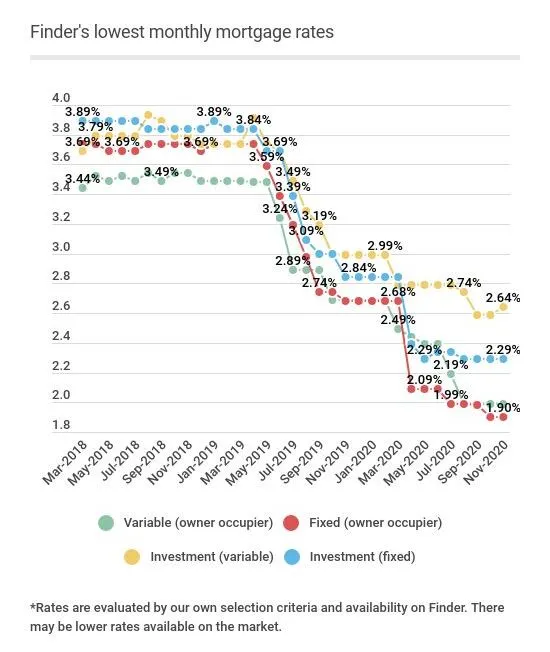

With an adjustable-rate mortgage , the interest rate may change periodically during the life of the loan. You may get a lower interest rate for the initial portion of the loan term, but your monthly payment may fluctuate as the result of any interest rate changes. The average rate on fixed-rate mortgages moved slightly lower yesterday while adjustable rate mortgages were higher across most loan terms. The exact amount that your interest rate is reduced depends on the lender, the type of loan, and the overall mortgage market. Sometimes you may receive a relatively large reduction in your interest rate for each point paid.

The FOMC policy statement, approved unanimously, was virtually unchanged from November's meeting. Some observers had expected the Fed to alter language that it sees "ongoing increases" ahead to something less committal, but that phrase remained in the statement. The consensus then pointed to a full percentage point worth of rate cuts in 2024, taking the funds rate to 4.1% by the end of that year.

What are points on a mortgage?

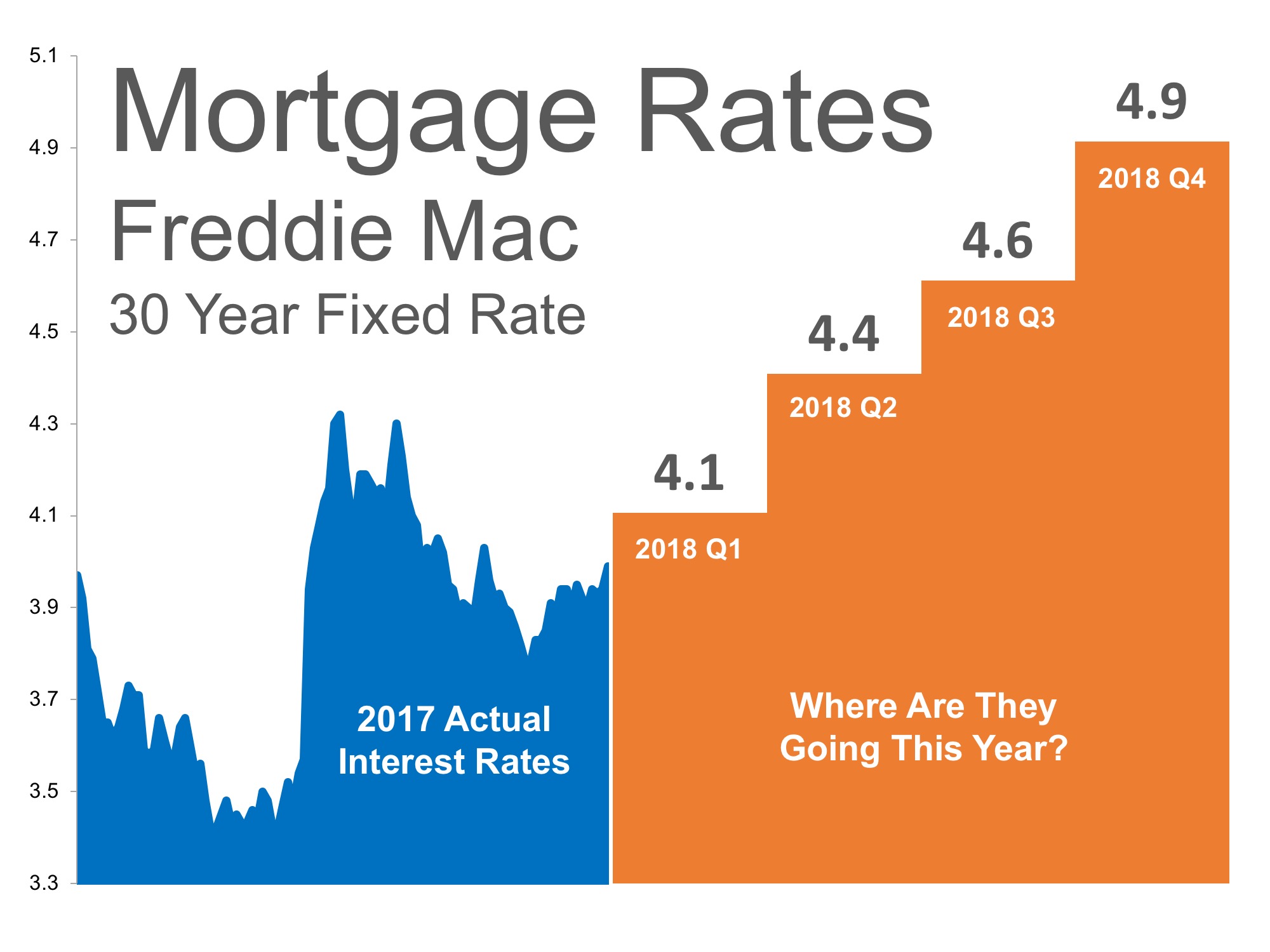

However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders. If your credit is a bit tarnished, many lenders offer loans with lower down payment and credit requirements through the FHA. Conventional loans are often ultimately bought by Fannie Mae or Freddie Mac, the big government-sponsored enterprises that play an important role in the mortgage lending market. They are offered by virtually every type of mortgage lender, with some programs allowing for a down payment as low as 3 percent. A conventional loan can be either conforming or nonconforming; the conforming loans are the ones backed by the GSEs.

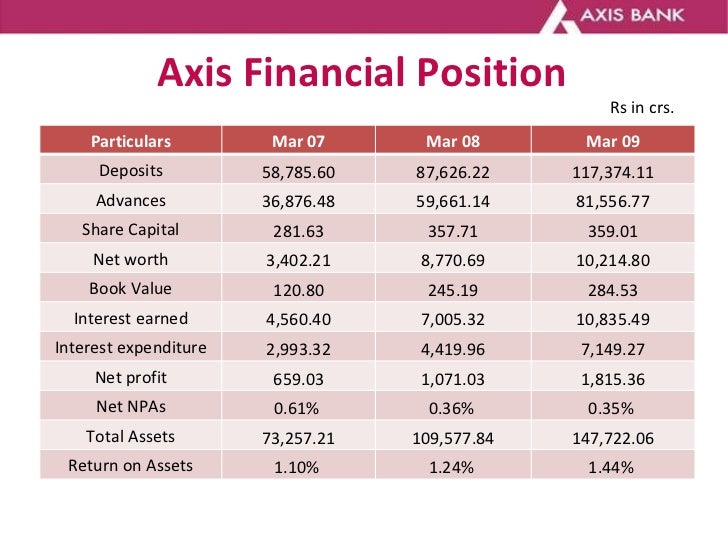

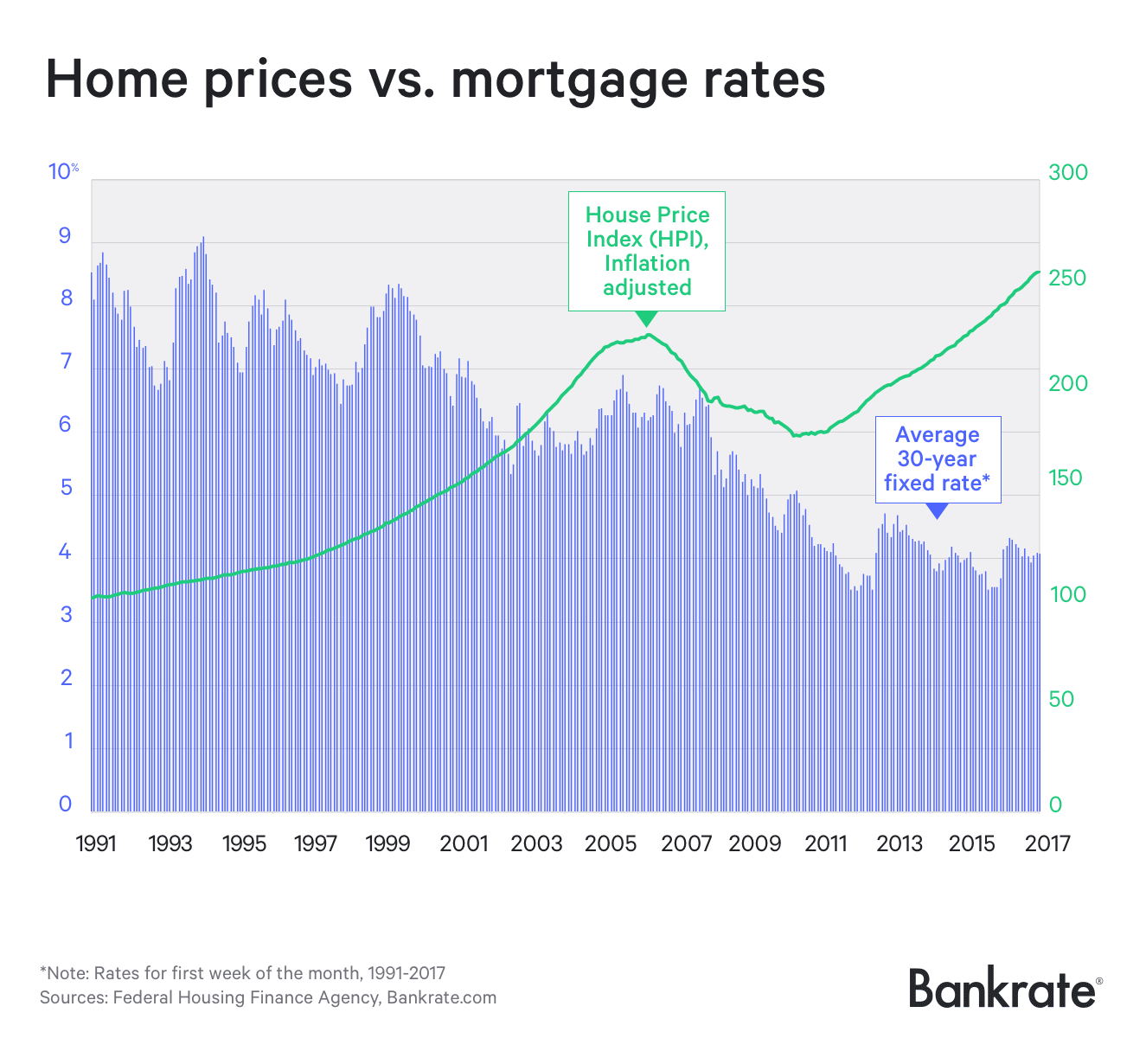

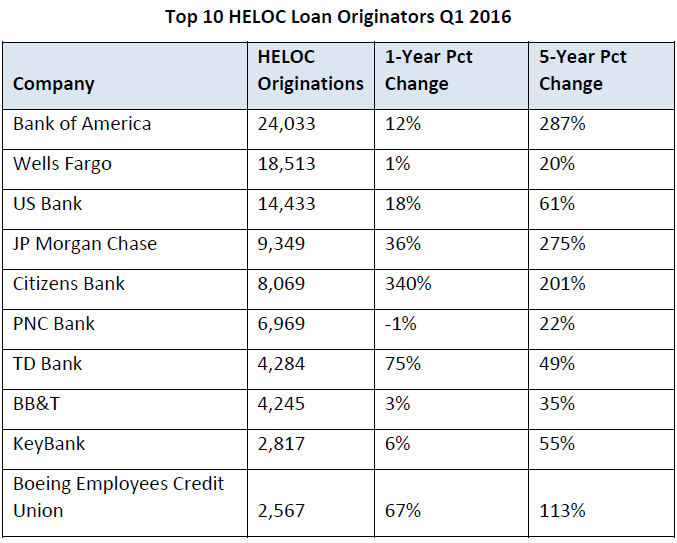

As a matter of fact, Fannie Mae predicted 2020 would be a record year for residential mortgage originations across the United States. They projected $54.1 trillion in total loan volume with around $2.7 trillion of that being refinance volume. The financial crisis of 2007 and 2008 sent the American housing market into a tailspin. New construction all but ground to a halt, and the market for existing homes was at its lowest point in recent history.

Why is my mortgage rate higher than average?

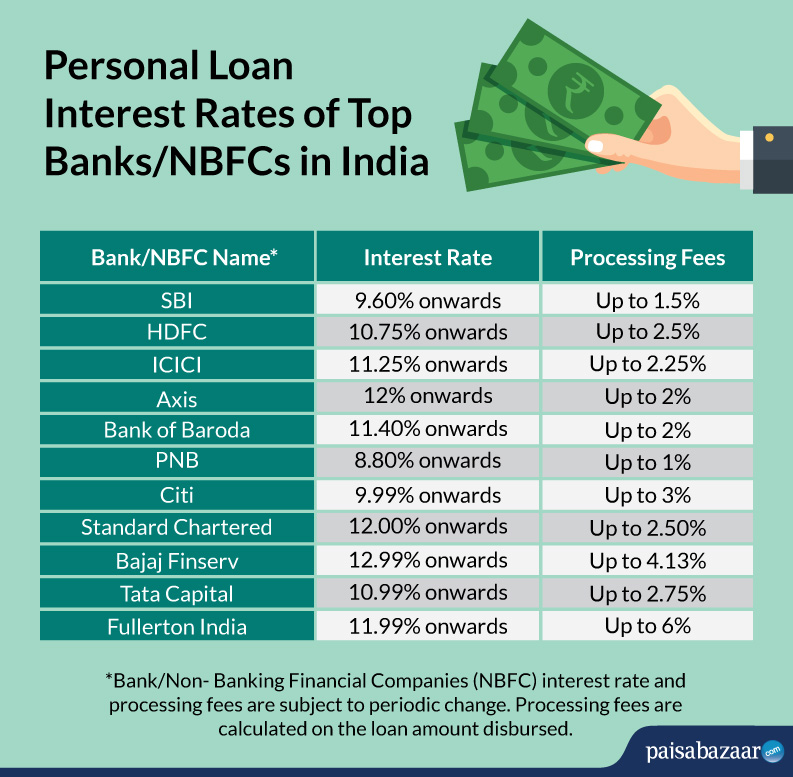

Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan. The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges. The average rate for a 15-year, fixed mortgage is 6.00%, which is the same rate as a week ago. Compared to a 30-year fixed mortgage, a 15-year fixed mortgage with the same loan value and interest rate will have a higher monthly payment.

Mortgage rates shown here are based on sample borrower profiles that vary by loan type. ARM Loans - Adjustable-rate loans and rates are subject to change during the loan term. APR calculation assumes a $725,000 loan with a 25% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees, if applicable. If the down payment is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Non-conforming rates are for loan amounts exceeding $647,200 ($970,000 in AK and HI). A 5/1 ARM has an average rate of 5.49%, a climb of 3 basis points compared to a week ago.

Fixed-rate mortgages

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you'd pay off your house sooner. It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about “float-down” options, which allow you to snag a lower rate if the market changes during your lock period. The number of existing homes sold declined for the ninth straight month in October — the longest decline on record, according to the National Association of Realtors. Leslie Cook is Money’s lead mortgage reporter covering trends in the housing market, mortgage rates and real estate.

Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after the closing date for adjustable-rate mortgage loans. Make regular prepayments – During the first few years of your home loan, you will be paying more towards the interest charged and less towards the principal.

First Time Buyers – The number of first time buyers entering the housing market fell to its lowest percentage since 1981. In 2014, first time buyers comprised 33% of the US housing market, a drop of five points from the previous year. As of the end of 2018 Q2 mortgage debt & home equity debt comprised 71% of total household debt. The global real estate market accounts for about 60% of all mainstream assets & was worth $280.6 trillion at the end of 2017.

A fixed-rate mortgage has an interest rate that doesn’t change throughout the life of the loan. Of course, if rates fall, you’ll be stuck with your higher rate unless you refinance. There are many types of fixed-rate mortgages, such as 15-year fixed-rate, jumbo fixed-rate and 30-year fixed-rate mortgages.

Be sure to compare APRs, which include many additional costs of the mortgage not shown in the interest rate. Keep in mind that some institutions may have lower closing costs than others, or your current bank may extend you a special offer. There’s always some variability between lenders on both rates and terms, so make sure you understand the full picture of each offer, and think about what will suit your situation best. Comparison-shopping on Bankrate is especially smart, because our relationships with lenders can help you get special low rates. Your lender will determine the rate on your VA loan based on market rates, your credit profile and your financial situation. You may qualify for a lower interest rate if you choose to make a down payment.

Thus, if you make housing loan prepayments, you will eventually bring down your outstanding principal, thereby reducing the interest in the process. However, some banks charge a certain percentage for loan prepayments, especially on fixed rate loans. Though the Fed does not directly set mortgage rates, the central bank's policy actions influence how much you pay to finance your home loan. If you're looking to buy a house in 2022, keep in mind that the Fed has signaled it will continue to raise rates, and mortgage rates could increase as the year goes on. Whether rates follow their upward projection or begin to level out hinges on if inflation actually slows.

Since 2008 most quarters have seen a net production income of between 25 and 75 basis points. The COVID-19 crisis created a boom in home purchase loans and in mortgage refinances. Interest rates fell, causing refinance volume to jump to around $2.7 trillion while the total transaction volume for 2020 is anticipated to be around $4.1 trillion.